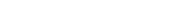

See which industries are being hit

Leaving the field: The bank credit tightening trend, already well documented, is now being underlined by the retreat of several banks from their equipment finance businesses.

Yes, but: In our survey of over 5000 small businesses, we discovered that credit tightening is not equal across industry sectors.

Takeaways: Striking the balance between high-demand assets and industries underserved by traditional lending is paramount to brokers right now.

- Chasing OTR transportation will find high demand but poor approval rates.

- Construction will find higher approval rates but far higher competition.

- But restaurant, auto repair, and small manufacturing might be niches worth exploring.

Our perspective: When companies require CapEx amid budget limitations and tighter credit, brokers are uniquely positioned to win. And partnering with a long-time funder of the broker channel with strong specialty in small-ticket transactions can help.

TimePayment offers flexible monthly payment options for equipment needs starting at $500 and reaching $500,000 and beyond.

Seize the opportunity: To discuss a vendor opportunity, reach out today. Or sign up now to get started.

*2024 Sawbux Greenwich Study of Commercial Finance Decision Makers