Vendors have the edge.

Where do most small businesses secure equipment financing? Here’s a hint: It’s not their primary bank.

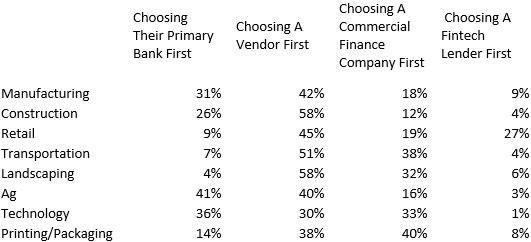

The real deal: A recent Sawbux survey of over 5600 small businesses found that those choosing their primary bank are in the minority.

By the numbers: Here’s a breakdown by industry segment:

Takeaways for brokers:

- Vendors are the preferred avenue of choice for equipment financing right now. In fact, in the aggregate, small businesses are almost twice as likely to explore options with vendors as their primary bank.

- Brokers supporting vendor efforts are far more likely to win in this environment than banks—even with all the pressure on rates.

TimePayment can help. With flexible monthly payment options for equipment needs starting at $500 and reaching to $500,000 and beyond, you can trust our innovative technology tools and creative capital solutions to give customers the options they need.

Take action: To discuss a vendor opportunity, reach out today. Or sign up now to get started.